If you’re living on your own and looking to buy a home, know that you can make your dream a reality with thoughtful planning and the right team of experts. Research from Freddie Mac shows 28% of all households (36.1 million) are sole-person, and that number is growing. Over the past 40 years, the number of sole-person households has nearly doubled, and that’s a trend that’s expected to continue. According to Freddie Mac:

“Our calculation suggests that there will be an additional 5 million sole-person households in the United States by the next decade. This means 42% of the household growth will be contributed by sole-person households, . . .”

If you fall into this category, here are three tips to help you achieve

…

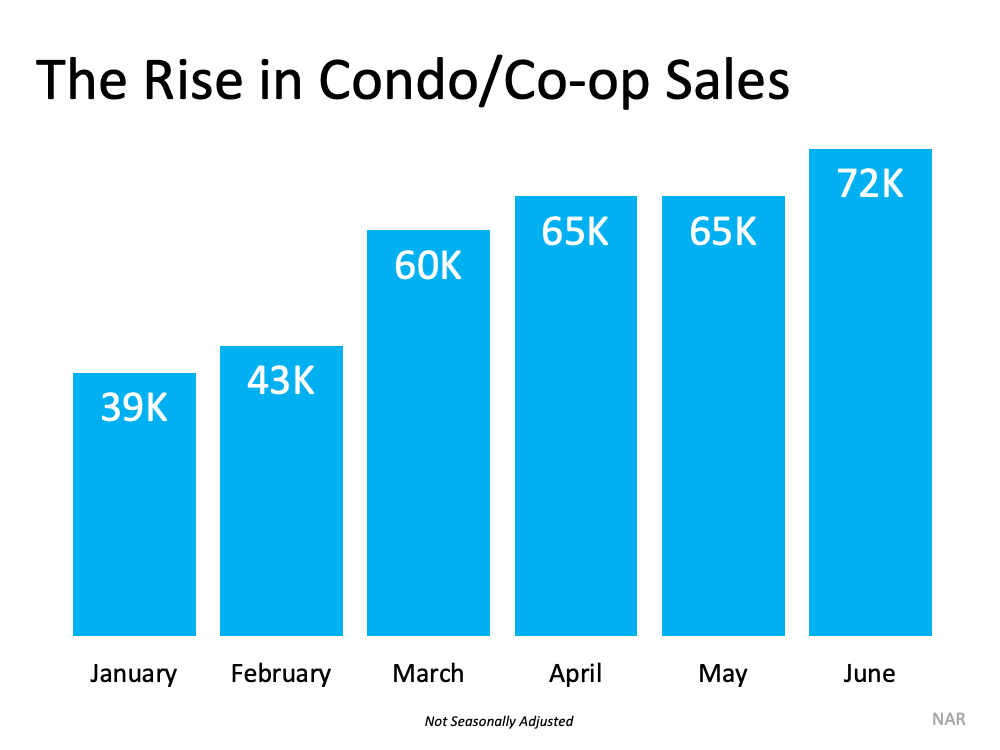

There are a few reasons more and more people are opting to buy condos – the benefits of condo life can be quite compelling. Let’s explore the main perks to find out if a condo is a good fit for you.

There are a few reasons more and more people are opting to buy condos – the benefits of condo life can be quite compelling. Let’s explore the main perks to find out if a condo is a good fit for you.

![Your Journey to Homeownership [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/11/18120549/20211119-MEM-1046x2358.png)

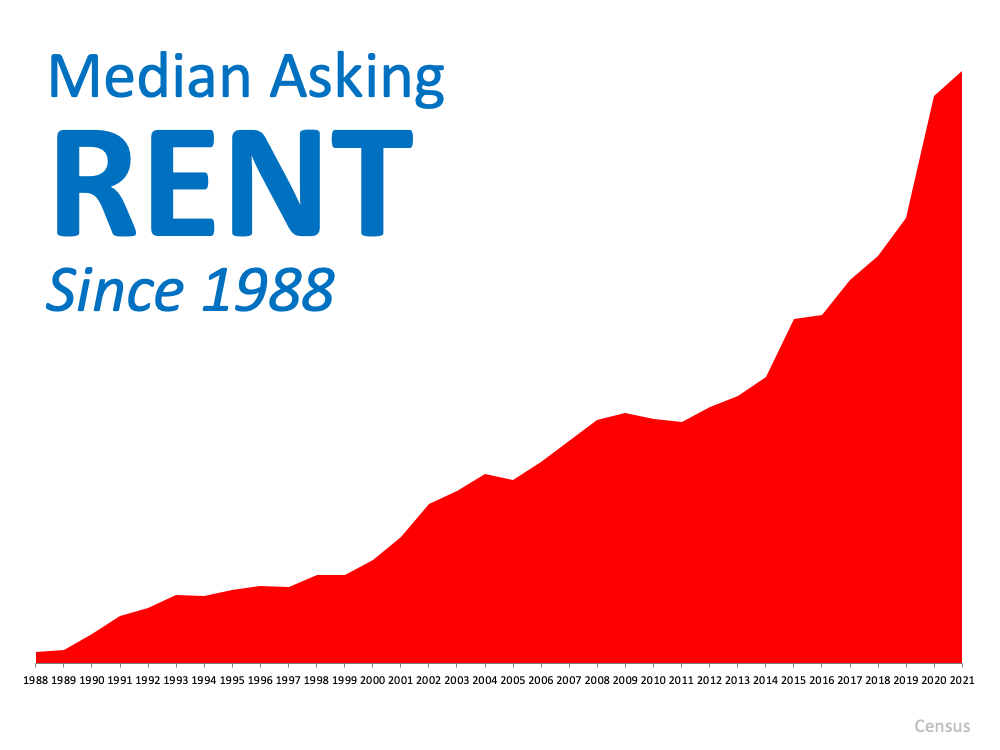

If you’re a renter, you’re faced with payments that continue to climb each year. Realtor.com recently shared the September Rental Report, and it shows price increases accelerating from August to September (see graph

If you’re a renter, you’re faced with payments that continue to climb each year. Realtor.com recently shared the September Rental Report, and it shows price increases accelerating from August to September (see graph

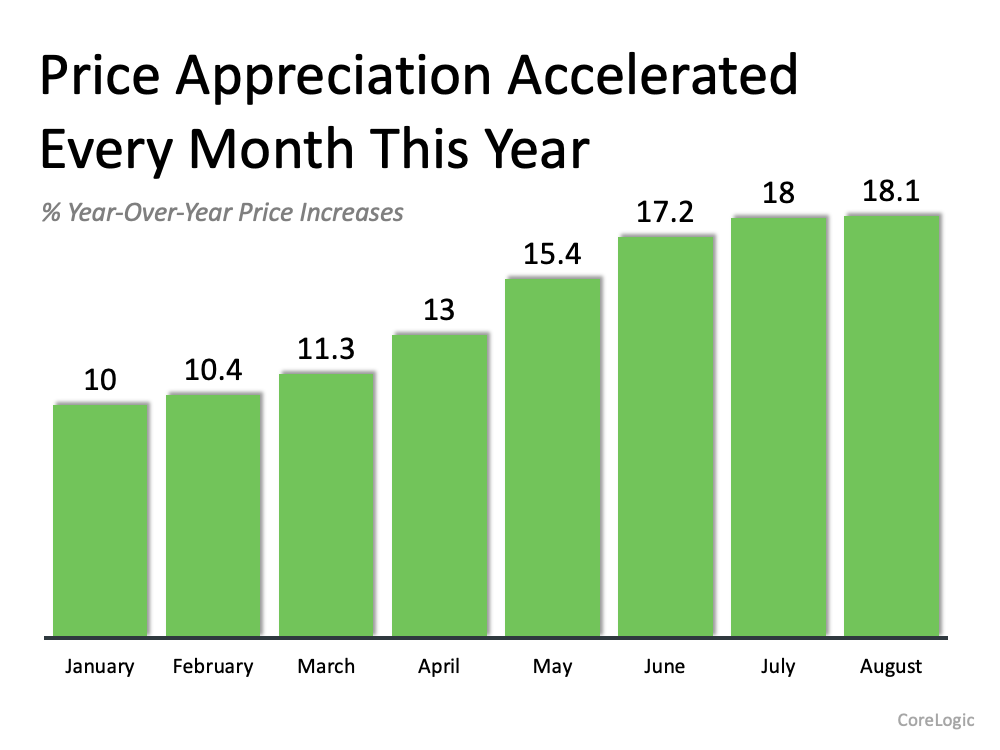

The increase in the rate of appreciation that’s shown by CoreLogic coincides with data from the other two main home price indices: the FHFA Home Price Index and the S&P Case Shiller Index.

The increase in the rate of appreciation that’s shown by CoreLogic coincides with data from the other two main home price indices: the FHFA Home Price Index and the S&P Case Shiller Index.

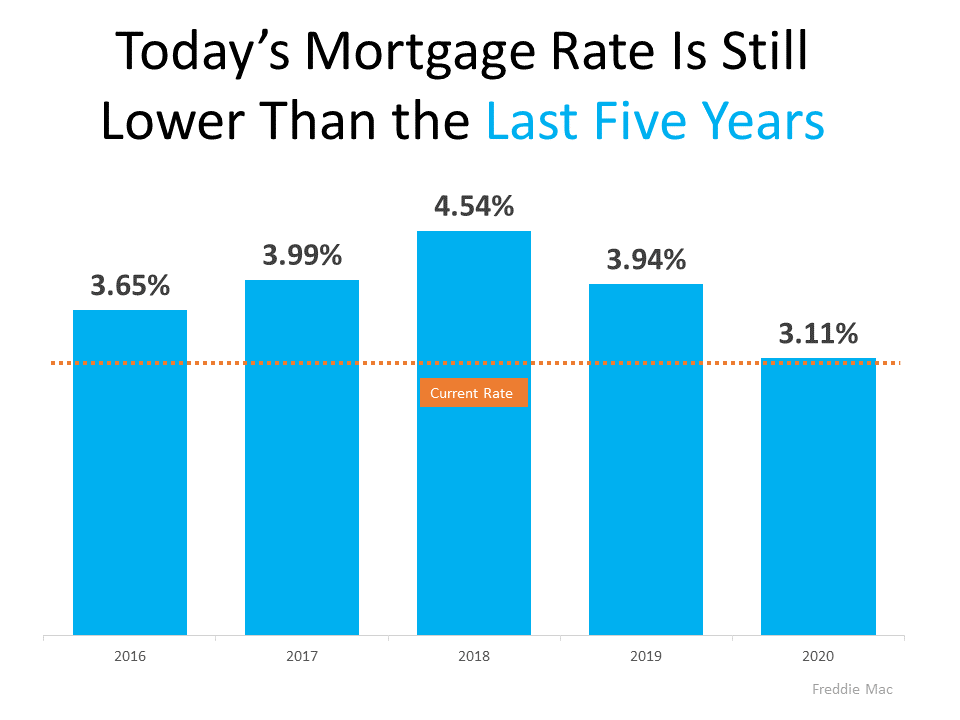

As the graph shows, even though today’s rate is

As the graph shows, even though today’s rate is