Did the frequency and intensity of bidding wars over the past two years make you put your home search on hold? If so, you should know the hyper competitive market has cooled this year as buyer demand has moderated and housing supply has grown. Those two factors combined mean you may see less competition from other buyers.

And with less competition comes more opportunity. Here are two trends that may be the news you need to reenter the market.

1. The Return of Contingencies

Over the last two years, more buyers were willing to skip important steps in the homebuying process, like the appraisal or the inspection, in hopes of gaining an advantage in a bidding war. But now, things are different.

The latest data from the National

…

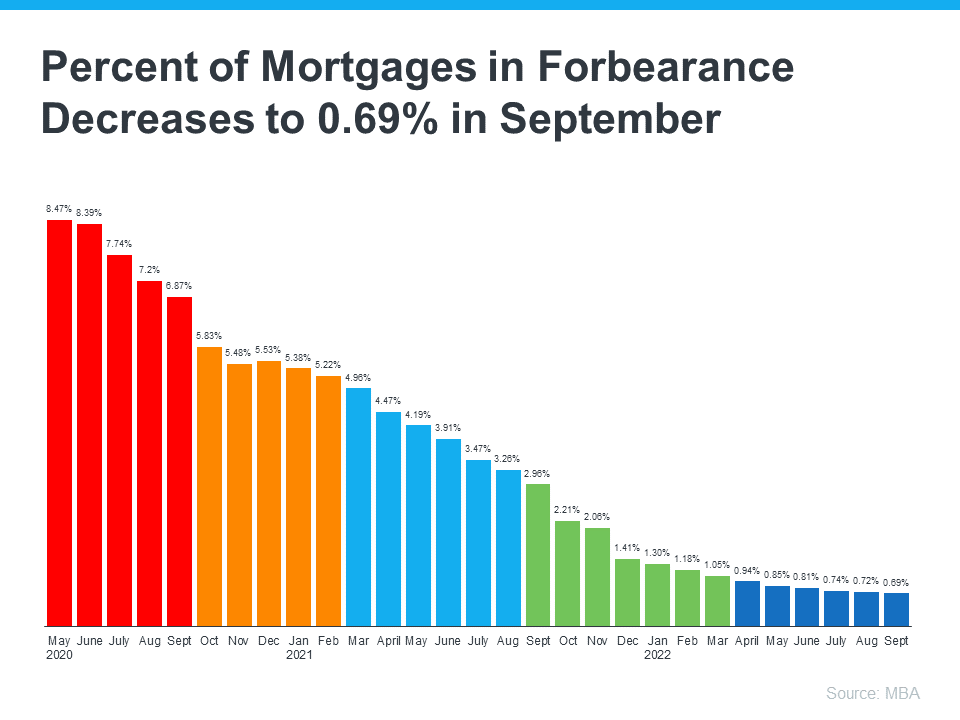

But even though the volume of homeowners at risk is very low, there is still a small percentage of homeowners who may be

But even though the volume of homeowners at risk is very low, there is still a small percentage of homeowners who may be

![Homeownership Wins Over Time [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/11/03124833/20221104_homeownership-wins-over-time-MEM-1046x2364.png)