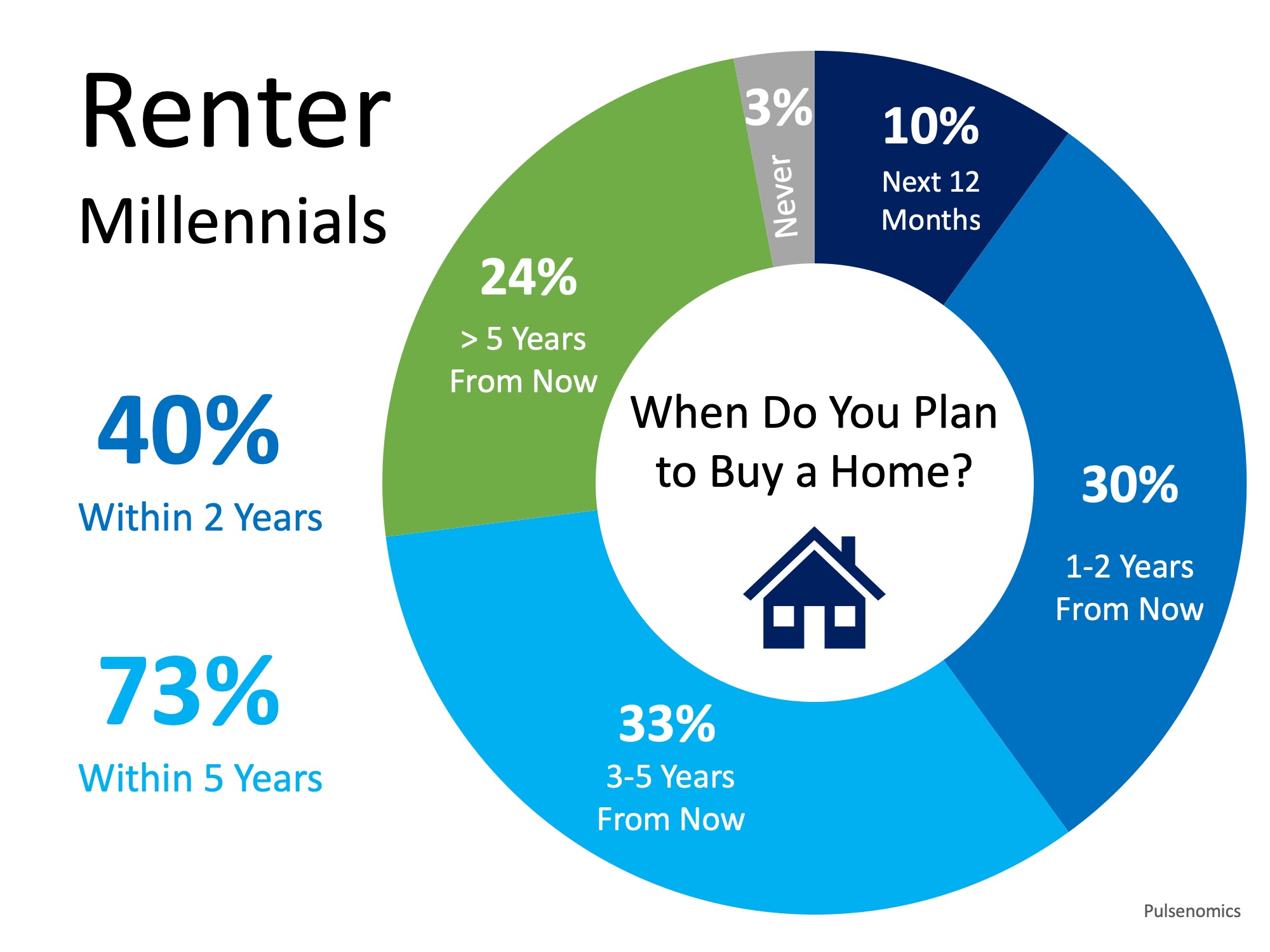

If you’re a first-time homebuyer, you may be wondering: Should you purchase a small starter home to get into the market now, knowing you may grow out of it in a few years? Or, should you stretch your budget — or spend more time saving — to get a “forever home” that will take care of your long-term needs?

Here are some factors to consider as you weigh whether to get a home best suited for the short term or the long haul.

First-time homebuyer factors

Market conditions: Mortgage rates are historically low, but there’s no telling how long that will last. Consider whether to jump in before home prices get even higher, or whether they may weaken.

Where you want to live: Consider if you’d be OK living for a few years in the suburbs, where

…