According to Bankrate’s latest Financial Security Index Poll, Americans who have money to set aside for the next 10 years would rather invest in real estate than any other type of investment.

Bankrate asked Americans to answer the following question:

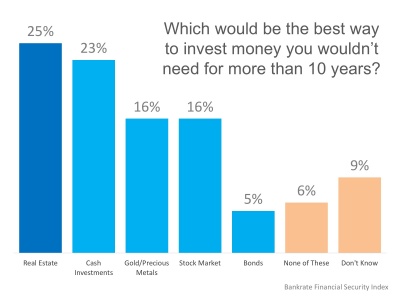

“Which would be the best way to invest money you did not need for more than 10 years?”

Real Estate came in as the top choice with 25% of all respondents, while cash investments (such as savings accounts and CD’s) came in second with 23%. The chart below shows the full results:

Sterling White, co-founder of Holdfolio, gave one reason as to why real estate may have ranked so high.

"Houses are tangible. You can physically see and feel the product. So you know where your money is

…